Fraud Will Remain a Top Banking Threat in 2026 – Why AI Must Move at the Speed of Payments

Fraud Isn’t Slowing Down – It’s Accelerating

Fraud surged across the financial services industry in 2025, and according to new research from American Banker, most banking leaders expect that pressure to continue into 2026. The reason is straightforward: the same AI tools banks are adopting to improve operations are also empowering fraudsters to move faster, automate attacks, and exploit real-time payment rails.

American Banker’s 2026 Predictions report, based on responses from 174 banking professionals across banks, credit unions, neobanks, and payments firms, makes one reality unmistakably clear:

Fraud is no longer a back-office problem. It is a real-time problem.

And real-time problems require real-time intelligence.

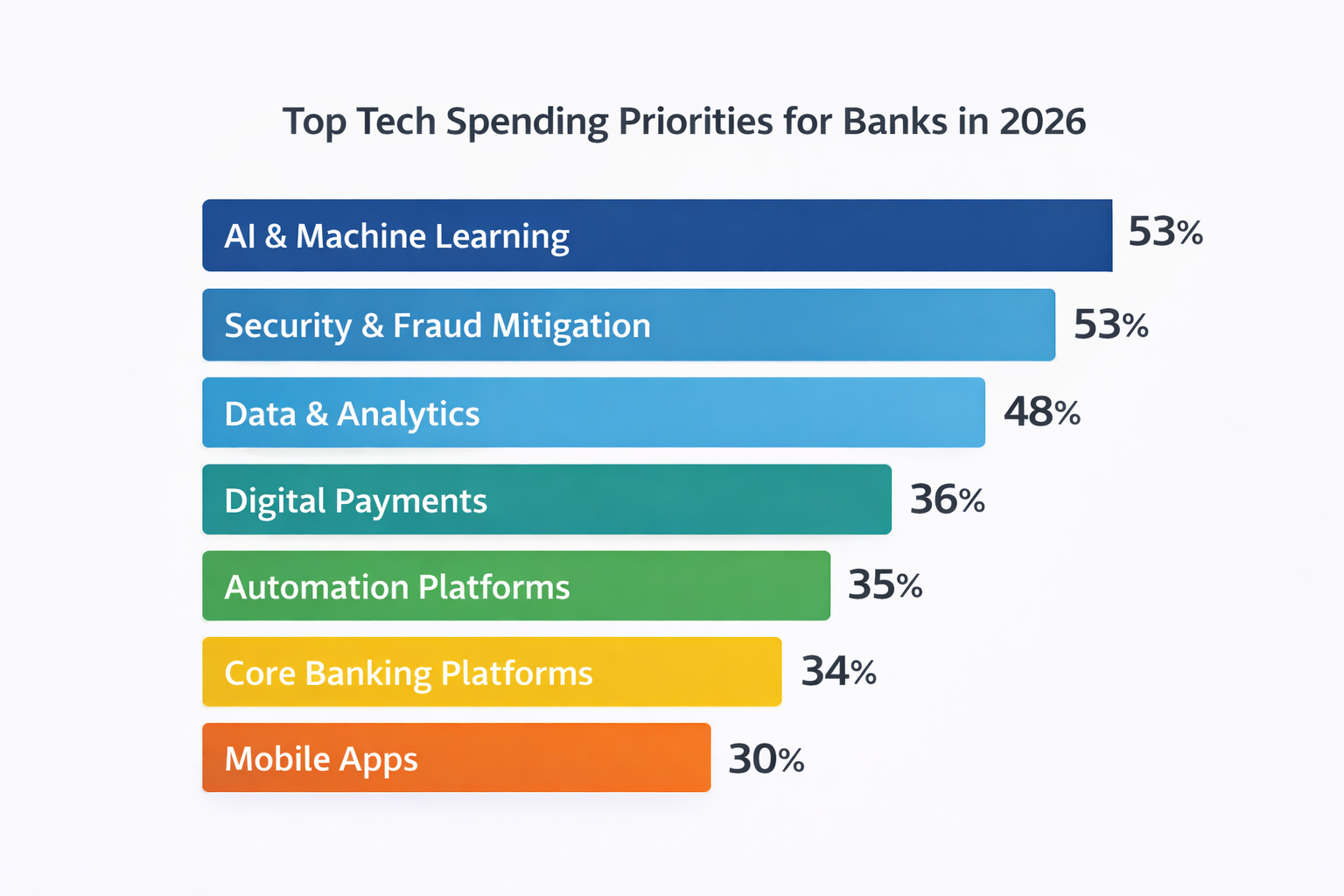

Top Technology Spending Priorities for Banks in 2026

(Based on American Banker research)

(Based on American Banker research)

Key takeaway from American Banker:

AI and fraud mitigation are tied as the top technology spending priorities for 2026.

What This Means

Banks aren’t investing in AI for experimentation anymore. They are investing because fraud pressure — especially on instant payment rails — leaves no margin for delay.

This is precisely where RembrandtAi® operates: real-time fraud intelligence designed for real-time money movement, including FedNow and other instant payment systems.

Stablecoins, Crypto, and the New Payments Risk Landscape

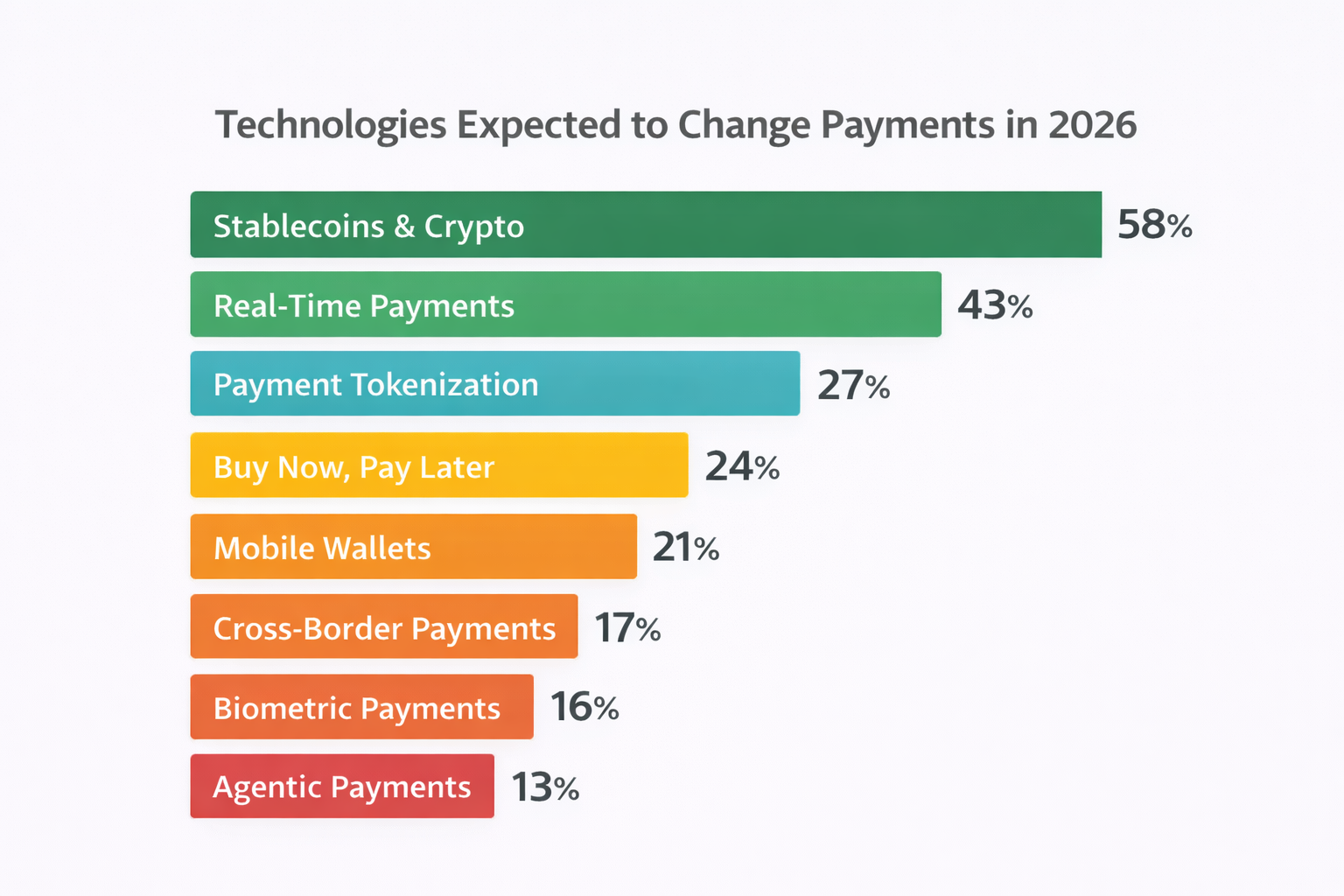

American Banker’s data shows that 58% of bankers believe stablecoins and cryptocurrencies will be the biggest forces changing payments in 2026, followed closely by real-time payments.

Technologies Expected to Change Payments the Most in 2026

Key takeaway from American Banker:

Key takeaway from American Banker:

Payments are becoming faster, programmable, and irreversible — all characteristics that increase fraud exposure.

The Strategic Gap

Legacy fraud systems were built for batch processing and post-transaction review. That model breaks down when funds settle instantly.

RembrandtAi® was engineered for this exact moment: continuous risk assessment that operates in-line with payment execution, not after the fact.

AI Is Reshaping Bank Operations – Fraud Comes First

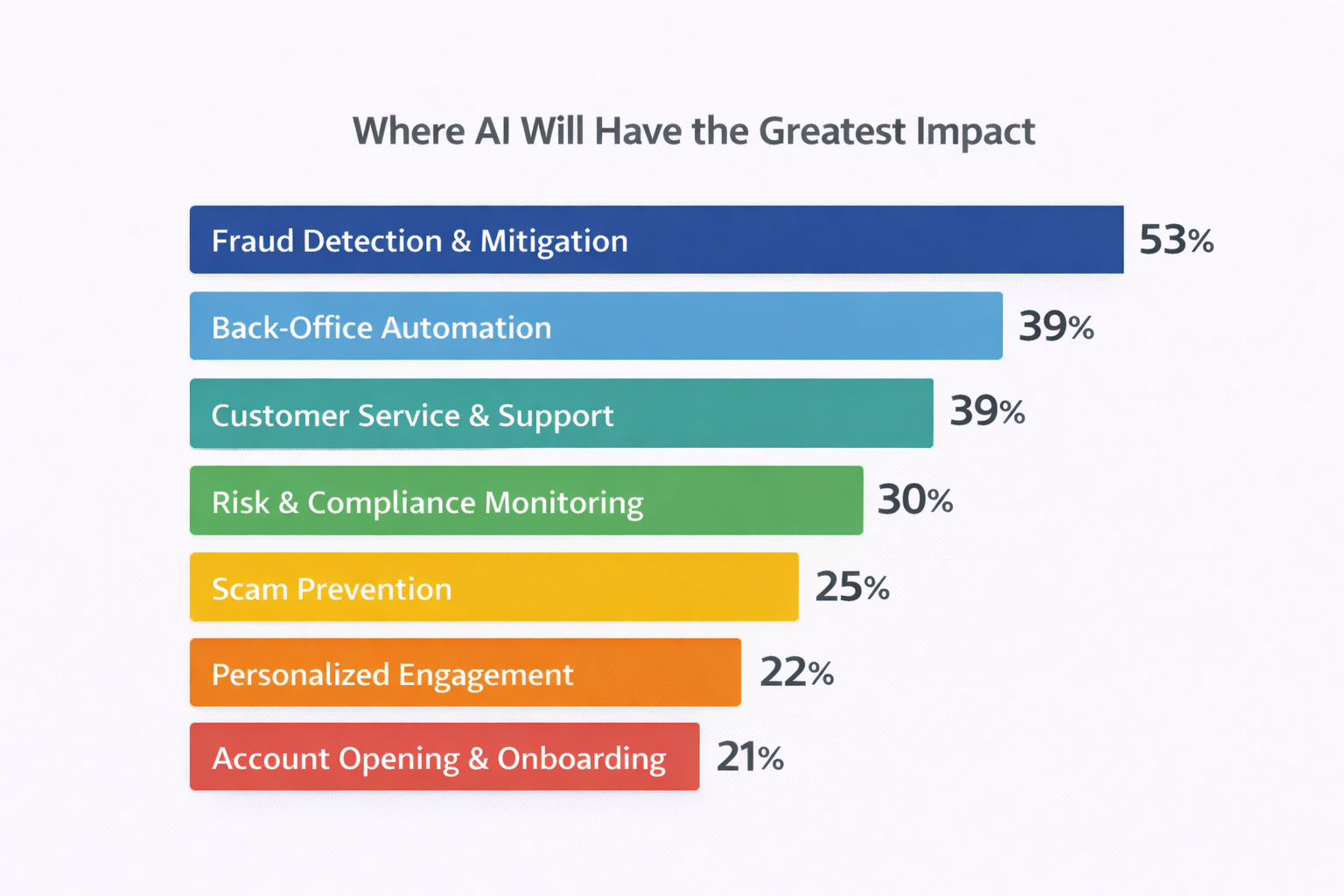

When bankers were asked where AI would have the greatest impact in 2026, fraud detection and mitigation ranked number one.

Where AI Delivers the Greatest Impact

Across banks and credit unions of all sizes, fraud was consistently ranked as the top AI use case.

Across banks and credit unions of all sizes, fraud was consistently ranked as the top AI use case.

This aligns directly with RembrandtAi®’s mission:

Make fraud prevention instantaneous, explainable, and operationally usable — not theoretical.

Real-Time Payments: The #1 Fraud Battleground

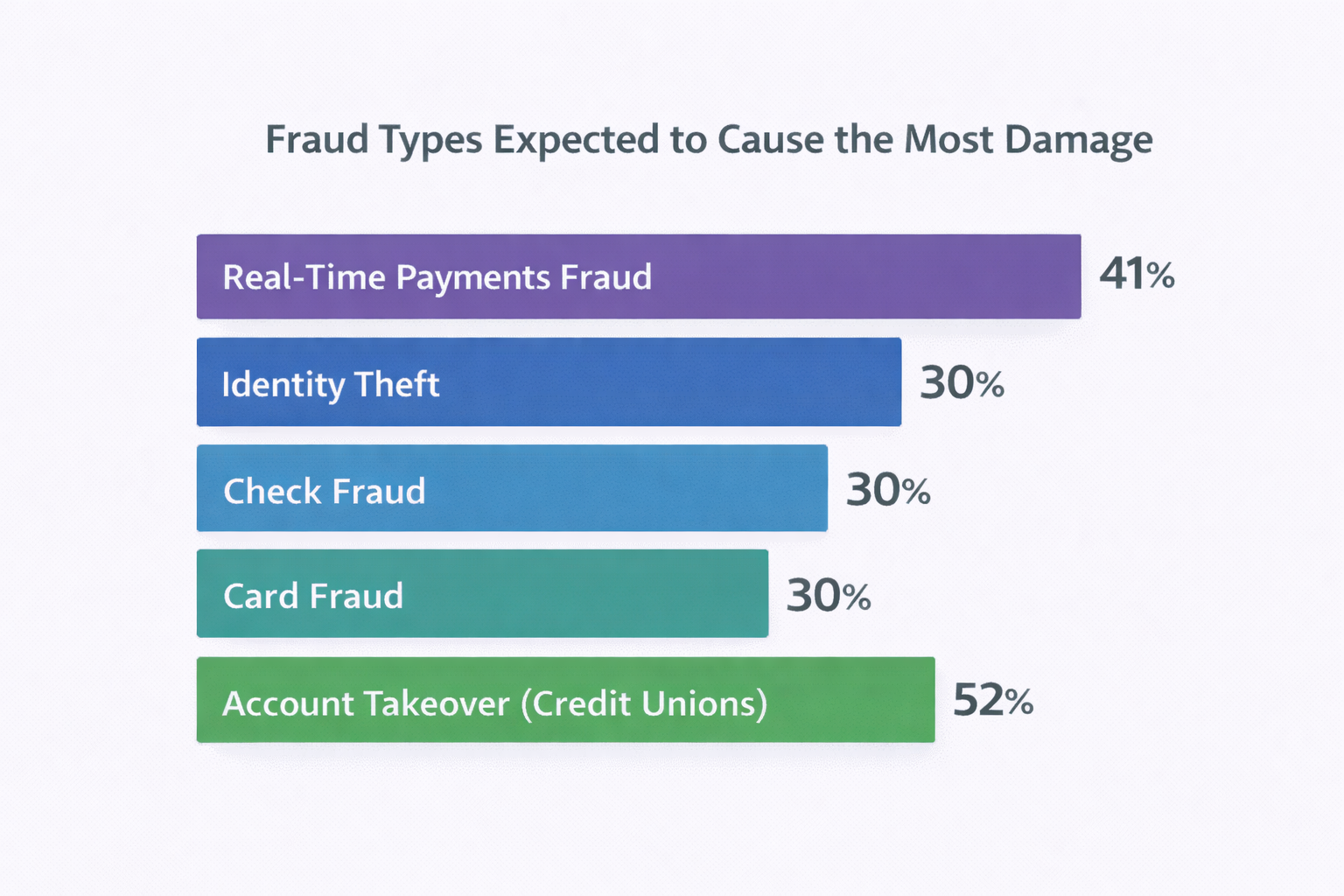

American Banker’s findings show that 41% of respondents believe real-time payments fraud will have the biggest negative impact on their organization in 2026.

Fraud Types Expected to Cause the Most Damage

Key takeaway from American Banker:

Key takeaway from American Banker:

Instant payments remove recovery windows — once money moves, it’s gone.

Why This Matters for FedNow

FedNow was designed to modernize payments. It also demands a new fraud posture — one that evaluates risk before authorization, not after settlement.

RembrandtAi® delivers that capability by embedding real-time fraud intelligence directly into payment decisioning workflows.

American Banker’s research confirms what leading financial institutions are already experiencing:

- Fraud will remain a top threat in 2026

- AI is essential – but only if it operates in real time

- Instant payments demand instant risk decisions

This is not about adding another dashboard.

It’s about re-architecting fraud defense for a real-time financial system.

RembrandtAi® represents that shift — purpose-built to help banks and credit unions protect customers, comply with evolving regulations, and confidently scale instant payments without increasing fraud exposure.

Source Attribution

All data and survey findings referenced in this article are sourced from:

American Banker – “Exclusive Research: Is AI an Effective Tool to Fight Fraud?”

https://www.americanbanker.com/payments/news/exclusive-research-is-ai-an-effective-tool-to-fight-fraud